Trusted Singapore Banks: All You Need to Know in 2025

Learn all about banks in Singapore with our guide. We cover the regulatory environment, the various types of banks available, including leading local banks, qualifying full banks, and digital banks, as well as deposits and balances. Plus, we explore potential issues for offshore businesses to consider. Whether you’re starting a new business or thinking about switching banks, our guide provides the essential information you need.

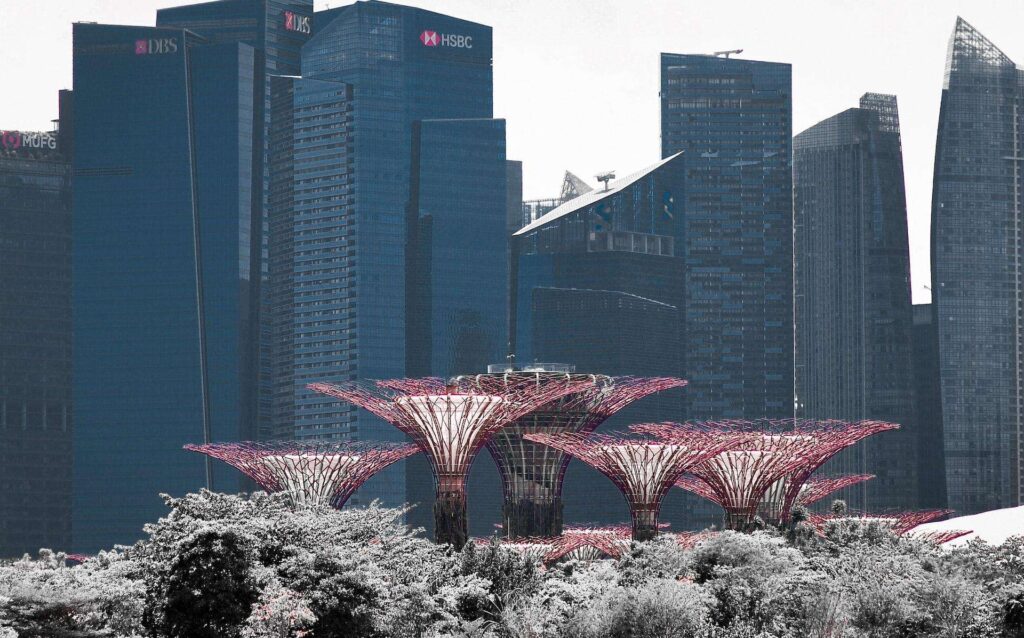

Singapore banks have a reputation for being reliable financial institutions and provide world-class banking services to hundreds of thousands of companies from around the world. In this article we provide an overview of banking sector in Singapore and discuss some current trends in bank rules. In other articles of this section, besides providing an overview of Singapore banking system, we will describe the nuances of opening and maintaining a bank account in Singapore based on today’s realities.

1. Regulatory Environment

Singapore banks are governed by the Banking Act 1970 and by the Monetary Authority of Singapore (MAS). MAS works as the central bank of the country and provides the framework and guidance for all banks in Singapore.

In recent years, implementations of anti-money laundering (AML) policies have been intensified around the world, and Singapore banks have not been an exception. All Singapore banks have raised KYC thresholds for their customers – especially for those who are non-residents of Singapore. This also applies to the owners of companies registered in Singapore who are not yet acting as Singapore residents.

Nevertheless, judging by the numerous customer reviews who have the opportunity to compare banking services in Singapore and in many other countries (including Europe), Singapore banks still differ for the better in many ways. There are definitely no ways that Singapore banks give “blind eye” on any transactions, but what is important is that they do not create any bureaucratic barriers unnecessarily. As a rule, “suspicious payments” are subject to additional scrutiny – when, for example, a payment is associated with a dubious counterpart or with a country from FATF list of high-risk countries. These measures provide an extra level of reliability to Singapore banks.

Because the Singapore banking regulator provides balanced approach, which comprises robust regulations for the financial stability and incentives for competitive development of banking system, you can rest assured that Singapore banking system will provide all the latest features to support your banking needs.

2. Types of Banks in Singapore

You should note that there are three types of banks in Singapore recognized by the regulator: full banks, wholesale banks and merchant banks.

Full banks

Full banks, also known as local banks, are licensed to provide any kind of banking and investment activities. This includes retail banking with personal and corporate bank accounts. There are three full banks in Singapore: DBS, UOB and OCBC. These are local banks and have multiple branches across Singapore. Branches of these banks also operate in nearby countries of South-East Asia, as well is in Hong-Kong and China. These are very large and strong banking institutions.

For example, since 2018, DBS bank was named The World’s Best Bank three times, according to Global Finance; World’s Best Digital Bank’ for 2021 according to Euromoney and The Global Bank of the Year 2021 by The Banker. OCBC Bank was named the World’s Best Consumer Bank in 2019 by Global Finance. UOB bank was named the Best Retail and Best SME Bank in South East Asia in 2021.

3. Leading Local Banks

- The Development Bank of Singapore (DBS): DBS is Southeast Asia’s largest bank, with offices and branches in South Korea, the United Arab Emirates, China, Hong Kong, the United Kingdom, the United States, and other countries. Bank’s corporate page: https://www.dbs.com.sg/corporate/default.page

- United Overseas Bank (UOB): UOB is Asia’s third-largest bank by assets. UOB has more than 19 offices worldwide, with a significant presence in China, Singapore, Malaysia, and Indonesia. Bank’s corporate page: https://www.uob.com.sg/business/index.page?lid=default-landing-bb

- Overseas-Chinese Banking Corporation (OCBC): OCBC Business Bank is Southeast Asia’s second-largest bank. OCBC is spread in 18 countries and has almost 570 branches. Bank’s corporate page: https://www.ocbc.com/business-banking

4. Qualifying Full Banks

The next layer of banks with full services are foreign banks operating in Singapore. Among them are Standard Chartered, HSBC, Citi Bank, Maybank, CIMB, Bank of India, Bank of China, Industrial and Commercial Bank of China and some others. They can operate as full banks with only limitation on the number of retail branches and ATMs in Singapore.

Thus, these Singapore banks can provide the same types of services as local banks, including retail banking for personal and corporate customers.

Some of the qualifying full banks in Singapore:

- CIMB Singapore: The CIMB Group is the fifth-largest banking group in ASEAN regarding assets. CIMB is one of the oldest and most trusted players, with retail banking operations launched in Singapore in 2009.

- Maybank: The fourth-largest bank by assets in Southeast Asia. The Maybank Group has a worldwide presence of 2,600 branches across 18 nations.

- ICICI Bank: ICICI is a Mumbai-based international financial and banking corporation. Since 2010, ICICI has been operating in Singapore and has a vast network throughout India.

- Singapore RHB Bank: Fully licensed Singapore bank with corporate services and a subsidiary of RHB Bank Berhad, one of Malaysia’s most prominent financial conglomerates.

5. Other Types of Banks: Wholesale, Merchant, Offshore

Wholesale Banks

Wholesale banks are restricted to only one location in Singapore and they cannot provide retail banking services in Singapore dollars. In fact, wholesale banks are targeted to large corporate customers who have their business footprint in Singapore and engaged mainly in international trading activity. They may also serve regional clients from the country where the parent bank is located. These banks usually do not onboard new clients without some prior history with the same institution.

Merchant Banks

Merchant banks concentrate on large-scale corporate finance, investment activity, shares underwriting, merger and acquisitions and private investment accounts. Examples: Bank of America, Barclay’s, Credit Swiss.

Offshore Banks

All offshore banks in Singapore are registered as branches of their parent foreign banks. Offshore banks are bound to operate via Asian Currency Units when dealing in foreign currencies in the Asian Dollar Market. When they need to make transactions in Singapore dollars, they have to do so through the separate Domestic Banking Unit (DBU). Examples: Bank of Taiwan, Bank of Roma, Arab Bank.

6. Digital Banks

Clearly, Singapore banks overview would not be complete without mentioning Singapore digital banks. Digital Banks scene in Singapore is emerging and still quite new. The first few digital banking licenses were issued in 2020 and it is expected that the first digital banks will come into operation this year. Among them are Grab-Singtel joint venture and Sea Limited.

There are two types of Digital Bank License: Digital Full Bank and Digital Wholesale Bank.

- Digital Full Bank can provide full scope of digital banking services, such as current and deposit accounts, loans and investment products to both personal and corporate clients.

- Digital Wholesale Bank will be able to provide services to corporate customers, mostly SMEs, without operating retail outlets.

There are also foreign digital banks which are licensed to operate in Singapore. They usually operate under Capital Market License issued my MAS. Among them are well-known international companies like Wise and Airwallex, and also local start-ups like Aspire and Anext. We provide a more detailed review of such digital banking services in our article Online Banks for Singapore Companies.

Because of many limitations and increasing requirements that Singapore Banks impose on their customers, the growth of popularity of digital banks is expected and inevitable. Besides, the growth of alternative banking services promotes competition and improvement of services by traditional banks. It also reduces transfer fees and account maintenance fees.

7. Choosing a Bank in Singapore

If you are a you are registering a new company or expanding to Singapore, you will be able to choose between a plethora of full local or foreign banks where you can open a bank account. One of main advantages of Singapore banking system is that all the banks provide very competitive fees for local and international transfers.

Since all banks provide all the necessary services that a start-up company will need, one important factor will be the size of initial deposit and service fees.

8. Deposits and Balances

The majority of banks in Singapore offer quite reasonable rates and fees in relation to cost of transfers and currency exchange, which generally amount to an average of 0.125% of the amount and/or are limited to maximum commission of $50-100 per outgoing transfer. Incoming transfers from overseas involve minimal fees, usually in the region of $10-20 per transfer.

When opening a corporate business account, the minimum deposit can be as low as $ 500-1000 (OCBC, DBS, UOB, Maybank, CIMB). However, the conditions for foreign-owned companies have begun to change recently. For example, DBS Bank differentiates foreign clients from locals and therefore offers “Premium” business accounts for offshore customers; with at least 50 thousand US dollars as an initial deposit to activate the account. At the same time, the bank will charge a one-time account opening fee of $500. In other banks the account opening fee can vary; HSBC, for example, will charge USD 1,200 or more, and Citi will charge USD 5,000-10,000, which is the highest known business account opening fee charged by a bank in Singapore.

As for the minimum average balances, they also differ from bank to bank and can range from $5,000 to $50,000. This does not mean that this money should always be in the account or that the bank will hold this amount, not at all. It’s just that if the average daily balances throughout the month are below these amounts, the bank will charge monthly “fall-below” fee for account. Majority of Singapore banks will charge $50-100 per month as fall below fee.

9. Potential Issues for Offshore Businesses

Despite some difficulties due increased KYC requirements from banks towards their customers, opening an account for legitimate businesses represented by non-resident clients is completely viable. Thousands of businessmen from all over the world choose Singapore not only to incorporate the company but also to establish a bank account.

Generally, the main criterion banks use when accepting a client is the presence of business relations in Singapore, such as suppliers, customers, or key partners. Banks may also consider clients whose business is closely connected not directly with Singapore, but with Southeast Asia or China. From the bank’s perspective, there must be a clear business need to open a Singapore bank account. When a bank officer asks, “What is the reason for opening an account in Singapore?”, answers like “low taxes and a reliable banking system” are not considered sufficient. These responses are unlikely to help the bank make a positive decision regarding the account opening for your company.

Conclusion

Please keep in mind that there are many nuances in working and communicating with Singapore bankers. We leave in the age when it is not the client who chooses the bank, it is rather a bank who chooses the client. This is why it is obviously much better to approach the bank fully prepared, so it will save both time and effort.

In other articles in this section, you can find information on how to best prepare yourself to apply for a corporate bank account in Singapore; which bank to choose and what options are there for opening personal accounts.

INTRACORP provides the most reliable corporate services in Singapore. We are striving to provide the most up-to-date and accurate information on our website about doing business in Singapore.