Progressive Wage Credit Scheme (PWCS): The Definitive Guide

What Is the Progressive Wage Credit Scheme (PWCS)?

As a replacement for the temporary Wage Credit Scheme (WCS) that ended in March of 2022, the Progressive Wage Credit Scheme (PWSC) is a transitional wage support program established in the Singapore Budget 2022. Its ultimate goal is to increase wages for low-earning workers between 2022 and 2026.

The scheme is intended to financially support employers in terms of the required wage raises for lower-wage workers as a result of Progressive Wage Model regulations, Local Qualified Salary requirements, and voluntary wage raises.

Benefits of the Scheme

Financial support for employers: With the co-founding of the PWCS to increase the wages of lower-wage workers, employers can focus on other financial aspects that can bring further economic growth to their company.

Wage increases for employees: Since there is no need for employers to apply for the PWCS, eligible employees do not miss out on the wage increase opportunity and, as a result, gain a greater source of income.

Improved employee morale and retention: By encouraging wage increases, the PWCS contributes to improving employee morale and job satisfaction. When workers feel adequately compensated for their efforts, they are more likely to stay with the company.

Nationwide sustainable business growth: By assisting businesses in managing wage costs and improving productivity, the PWCS contributes to the long-term sustainability and competitiveness of companies. This, in turn, supports economic growth and stability in Singapore.

How Does the Scheme Work?

The Inland Revenue Authority of Singapore (IRAS) automatically notifies employers about whether they are eligible to receive co-founding shares to raise the wages of employees. In order for a company/employer to be considered eligible, however, one or more of its employees must satisfy the established requirements.

If you as an employer are deemed eligible to receive the scheme’s financial assistance, you will receive a payout determined by the IRAS that corresponds to the qualifying year and the wage increase of each employee that meets the required criteria.

Who Qualifies for the Scheme?

There is no application that must be completed to enroll in the scheme. Instead, your company will be automatically registered by the IRAS if one or more of its employees meet the following criteria:

- Be a Singapore Citizen or Permanent Resident.

- Received Central Provident Fund (CPF) contributions from a single employer for a minimum of three months in the previous year.

- Be part of the employer’s payroll for at least three months in the qualifying year.

- Received a minimum average gross monthly wage increase of S$100 in the qualifying year.

- Have an annual wage that falls in Tier 1 (S$2,500 or lower) or Tier 2 (higher than S$2,500 and lower than S$3,000) salary ceiling categories established by the IRAS.

Your company will automatically receive a letter from the IRAS stating its eligibility and the amount of money payout money it qualifies for.

Who Is Excluded from the Scheme?

The following list consists of those that are excluded from the scheme in accordance with the IRAS:

- Entities that contribute to the CPF but are not formally registered in Singapore.

Foreign military units.

- High commissions, consulates, trade offices, embassies.

- International organizations.

- Local government entities, including branches of the state, departments, ministries, and statutory boards.

- Representative offices of banks, insurance companies, and other financial institutions registered with the Monetary Authority of Singapore (MAS), as well as news bureaus that function as representative offices.

- Representative offices of foreign companies, foreign government agencies, foreign trade associations, foreign chambers of commerce, foreign non-profit organizations, and foreign law firms.

- Schools receiving government assistance.

- Services and units associated with the People’s Association (PA) and grassroots organizations.

- Unregistered local or foreign organizations.

How Are Payouts Calculated?

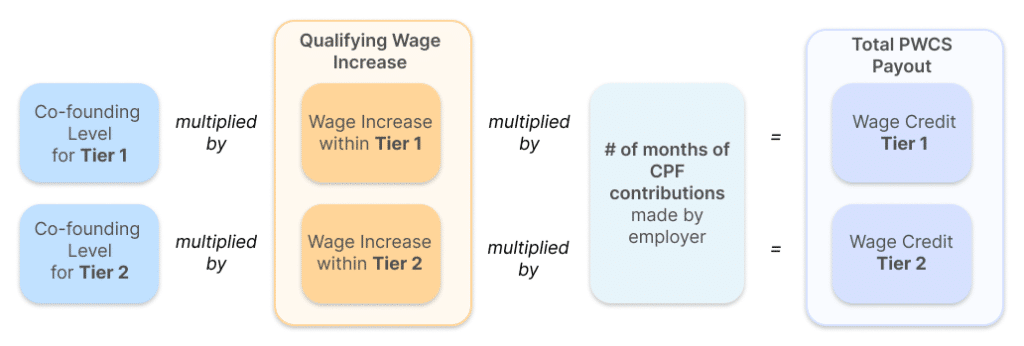

The Progressive Wage Credit payout is calculated for every qualifying employee with the following two formulas. The formula that applies to an employee depends on which tier they qualify for. As a reminder, Tier 1 qualifying employees must earn a maximum gross monthly wage of S$2,500, while Tier 2 employees must earn more than S$2,500 but S$3,000 at maximum.

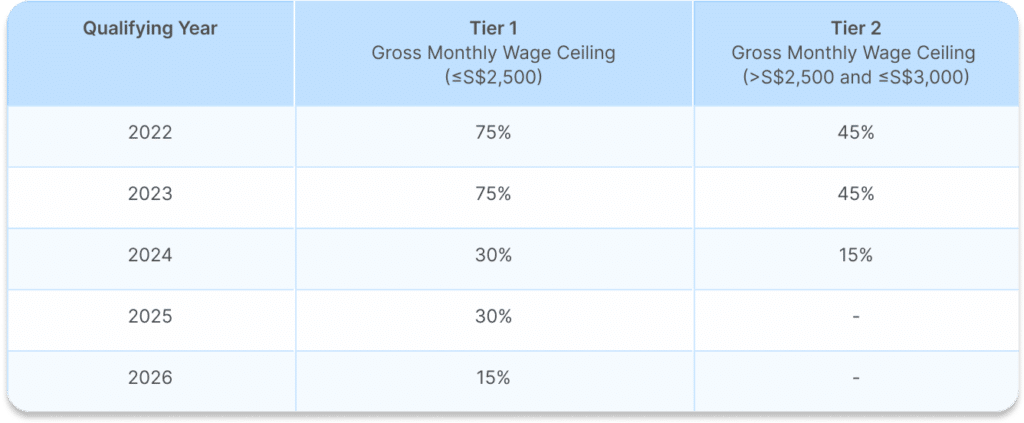

Employees can use the table below to find out what their co-founding level is in their corresponding tier and the year they qualify for.

Important Note: In the Singapore Budget 2023 it was announced that the government would increase the PWCS co-founding share from 50% to 75% for Tier 1 and from 30% to 45% for Tier 2.

How and When Do Employers Receive the Payout?

In most cases, payouts for Income Tax/GST are automatically credited to the qualifying employer’s GIRO bank account. However, if the employer does not have a GIRO account, the payment is credited to their PayNow Corporate-registered bank account.

The IRAS will notify qualified employers of the PWCS payout for each eligible year, and they can anticipate receiving the payout during the first quarter of the subsequent year. In other words, if an employer qualifies for a PWCS payout in 2023, they can expect to receive it in the first quarter of 2024.