Estimated Chargeable Income (ECI): Everything You Need to Know

In Singapore’s business landscape, understanding and complying with tax regulations is essential for every company. One crucial aspect of this is the Singapore ECI – the Estimated Chargeable Income that companies must file annually. In this article, we will demystify Singapore ECI by exploring who needs to file it, how the filing process works, the benefits of filing early and much more!

As a business owner in Singapore, adhering to the regulations established by the Inland Revenue Authority of Singapore (IRAS) is substantial for your company. Amongst the many compliance requirements that Singapore-registered companies have to follow – such as keeping accounting records and filing income tax returns – is the filing of the Estimated Chargeable Income (ECI). But, what exactly does the ECI entail? Well, that’s why we are here!

What is Estimated Chargeable Income (ECI)?

Estimated Chargeable Income (ECI) is your company’s estimated taxable profit (calculated after the deduction of tax-allowable expenses) for a Year of Assessment (YA). As an established requirement by the IRAS, every company must submit the ECI in the corresponding financial year to remain compliant with tax regulations.

In terms of how the Singapore ECI is calculated, the taxable profit pertains only to the primary income of your company, disregarding any indirect income received during the assessment year, such as sales of company property, shares, or dividends.

Who Needs to File ECI?

Every company in Singapore needs to file an ECI within three months after the end of its financial year except for those that are exempted in accordance with the guidelines of the IRAS. Your company does not need to submit an ECI if one of the two following conditions is met:

- The company’s annual revenue is less than S$5 million for the financial year and the ECI is nil (the company has no profits or is dormant) for the assessment year.

- The second condition is much less common and applies to companies that fall into one of the following categories:

- Approved CPF unit trusts and designated unit trusts

- Foreign Universities

- Foreign ship charters or owners who have or will submit the Shipping Return via a local shipping agent

- Real estate investment trusts that – under Section 43(2) of the Income Tax Act – provide special tax treatment

- Companies particularly granted an ECI waiver by the IRAS

If your company happens to meet one of the above conditions, you do not need to inform the IRAS, as it automatically identifies exempted companies.

What Is the Process to File the Singapore ECI?

As stated previously, your company must file its ECI within three months of its financial year-end. But, how exactly can an ECI be submitted?

The usual way to submit an ECI is through the IRAS web-portal. It can be done by an authorized individual such as a company director/secretary or a tax agent. It is good practice and very common for companies to have an experienced tax agent file the ECI on their behalf. However, it is possible for companies to do so on their own.

In order to file an ECI, the company must essentially perform these three steps:

- Gather the required information and estimate the tax payable (this is normally done by the tax agent along with the Financial Statement preparation)

- Assign the person to file the ECI via the IRAS website using the company’s CorpPass account

- File the Singapore ECI accordingly and receive the confirmation.

The IRAS has two official step-by-step guides for tax agents and companies to file the ECI. Below we have included both guides so that you can use the one that best pertains to your situation.

After you have completed the ECI filing process, you will receive a Notice of Assessment (NOA) if your ECI was filed correctly. You can then proceed to pay your taxes.

What Are the Advantages of Filing ECI Early?

As an incentive to encourage companies to file their ECI early, the IRAS has beneficial payment options in place for companies to pay their taxes in a more manageable way. This consists of an installment payment scheme through which companies can pay their taxes over a series of payments instead of all at once.

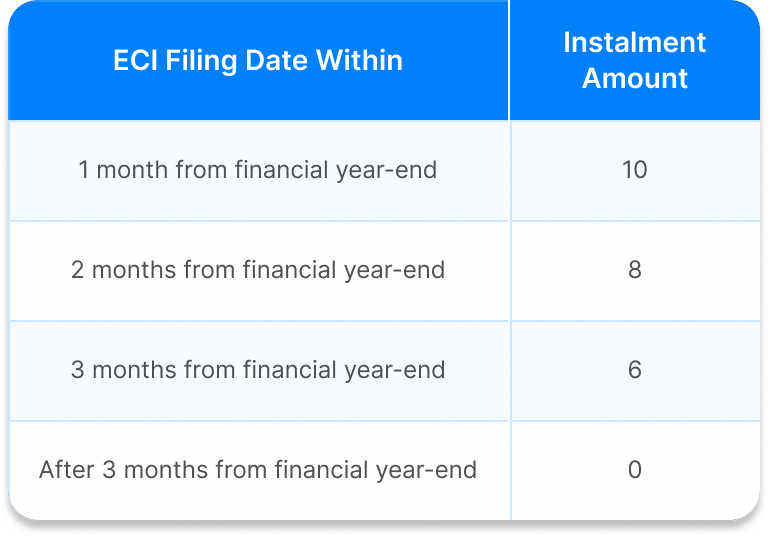

The IRAS grants a company a number of installments depending on how early its ECI was submitted.

Important Note

In order to obtain the installment benefits your company must be officially registered in Singapore and be on GIRO. To obtain the maximum number of installments you qualify for, the IRAS states that you must file the Singapore ECI before the 26th of the respective month.

Once your company submits its ECI on time, it will receive a Type 1 NOA. Afterward, your company can pay its taxes in the number of installments it was granted.

For example, if a company’s financial year ends in March and its ECI is filed by April 26th, it will receive the maximum number of installments (10) because the ECI filing date was within one month of the financial year-end and on or before the 26th day of the month. Assuming that the company has to pay an estimated chargeable income amount of S$1000, it can pay S$100 each month from May to February.

If, conversely, the company filed the ECI on or after July 1st (more than three months after the financial year-end), it will not qualify for installments and will have to pay the estimated tax amount in a one-time payment.

How Can You Pay Taxes After Filing the Singapore ECI?

Unless your company qualifies for installments, it is required to pay the corresponding tax estimate within one month of the NOA issuance. There are two ways for your company to pay:

Payment by GIRO

If a Singapore-registered company has a bank account with a major Singapore bank, it can be eligible for an interest-free installment plan through a GIRO (General Interbank Recurring Order) application. It allows you to pay the income tax over a number of fixed periods, rather than in one payment. The IRAS encourages companies registered in Singapore to pay their taxes through GIRO, which is a payment system arranged with your bank for automatic billing of government organizations such as the IRAS.

To get started with GIRO, you can complete a GIRO arrangement application form for corporate income tax, which can be downloaded from the IRAS website. This form, after being completed and signed by the company bank account signatory, must be sent to the bank for processing. It usually takes around 2 weeks for the bank to process, so keep that in mind prior to filing your estimated chargeable income.

Electronic Payment

Aside from GIRO, there are various other electronic payment options available, including internet banking, telegraphic transfer, SingPost, AXS, PayNow QR. These payment schemes allow you to make one-time payments or schedule payments in contrast to the automated GIRO payments. If the company does not have a bank account in Singapore, the only option to pay income taxes would be via telegraphic transfer.

Check out this official IRAS Corporate Income Tax Payment guide to learn more about the specifics of each payment option.

What If You Fail to File the Singapore ECI?

If your company does not file the Singapore ECI before the deadline of three months before the end of the financial year it will be issued a Type 2 NOA containing an ECI estimated by the IRAS, which can be potentially higher due to the consideration of your company’s income in past years.

Your company may file an objection two months from the date the NOA was issued if it does not agree with the IRAS estimate. However, even if the objection is approved, you must make the ECI payment within one month from the date of the NOA. If the IRAS approves the objection, any extra payment made will be refunded to your company.

The IRAS states that additional penalties may be imposed for companies that fail to pay the Singapore ECI payment by the due date.

Important Note

To prevent companies from further failing to submit the ECI, the IRAS requires companies to provide a reason for the late or failed filing when filing an objection.

Get Started With Intracorp

We know that at times, tax matters such as filing Singapore ECI can seem daunting, especially when compliance with the IRAS is essential to prevent business setbacks and penalties. That’s why at Intracorp, our team of tax professionals is here to help you file the ECI and plan effective tax strategies for the benefit of your company.

Reach out to us today to get started!