Investment activity is expected to rise as interest rates are forecasted to decline in the latter half of 2024

CBRE’s Singapore Market Outlook 2024 report released on Jan. 30, sets high hopes for the country’s investment activity.

Presented in the report by Managing Director of Singapore Advisory Services at CBRE, Moray Armstrong, investors remain cautious due to ongoing economic challenges despite the avoided recession in 2023. However, based on interactions with clients and partners, there is a growing optimism for the second half of the year when inflation and interest rates are anticipated to decrease.

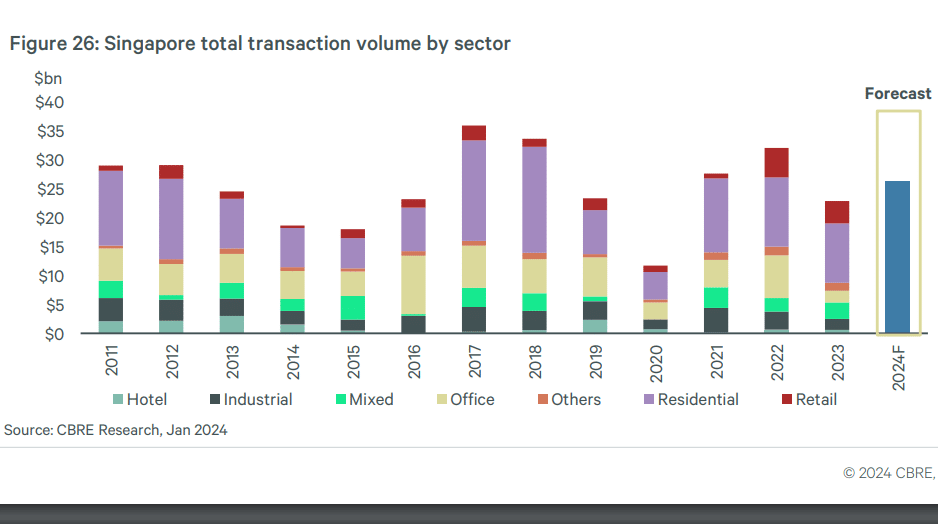

It is expected for investments to rise by 15% this year which is a significant recovery from the 29% year-on-year drop in 2023. The stabilization will occur against the background of expected reassessment of assets and a fall in the interest rate, which makes assets more attractive for potential buyers.

Compared to last year’s fall from the tech sector, the office market is expected to strengthen as well, if the leasing demand picks up in the latter half of 2024 as interest rates and inflationary pressures ease, the economy strengthens and companies regain confidence to embark on expansionary plans.

Tricia Song, CBRE Head of Research, Singapore and Southeast Asia, said there are healthy levels of demand persisting. It is expected that the Core CBD (Grade A) rents will grow at a rate of 2% to 3% in 2024, compared to a slight change from the 1.7% increase in 2023. The preference for buildings in the city centre that have good connectivity, high-end specifications and sustainability credentials, will be the lead cause of the CBD rents to grow. Many organizations are aimed at attracting the attention of clients and new employees with such workplaces with the described features.

New supply coming later this year will push office rents higher. It will be led by IOI Central Boulevard Towers, Labrador Towers and Paya Lebar Green.

According to CBRE, this year, investors remain confident and interested in the Singapore market. Last year, the country witnessed an impasse between buyers and sellers leading to a 29% year-on-year decline in real estate investments. Investors, however, could have confidence in the positive outcomes of their acquisitions. According to CBRE’s 2024 Asia Pacific Investor Intentions Survey, the majority of investors expect to purchase similar volumes or even more real estate in 2024.

Cross-border investments are also still taking place in Singapore because it offers macro-economic stability, pro-business environment and neutral political environment to investors.

“Singapore remains one of the most attractive investment destinations in the world given its exceptionally strong fundamentals and sustainable long-term prospects,” Armstrong said. “I am confident that for investors looking to improve the quality of their portfolios, it is a matter of “when” and not “if” picking up Singapore assets is high on the agenda.”